tax loss harvesting wash sale

For example imagine you purchased an Ethereum position for 10000 and you held the. In the event of a.

.jpg)

The Beginner S Guide To Cryptocurrency Tax Loss Harvesting Cryptotrader Tax

There are more options when applying a tax-loss harvesting strategy since the wash sale rule doesnt apply.

.jpg)

. The wash-sale rule states that your tax write-off will be disallowed if you buy the same security a contract or option to buy the security or a substantially identical security within 30 days before or after the date you sold the loss-generating investment. Using an investment loss to lower your capital-gains tax. Assuming youre subject to a 35 marginal tax rate the overall tax benefit of harvesting those losses could be as much as 8050.

If your business has more than one activity use the code that most closely. The Beginners Guide to Cryptocurrency Tax Loss Harvesting. Lets take a look at how this works.

Tax-loss harvesting is a strategy that can help investors minimize any taxes they may owe on capital gains or their regular income. Expertly Tax Manage Every Portfolio With No Incremental Effort. Cost Basis refers to the amount it costs you to acquire the coin.

Provide every client with expert automated tax management including tax-sensitive transition management wash sale avoidance ongoing gains deferral year-round tax-loss harvesting and tax budgets. The leftover 2000 loss could then be carried forward to offset income in future tax years. The Wash Sale Rule May Be Coming to Crypto in 2022.

Investors should educate themselves about the IRS wash sale rule described in IRS Publication 550. A listing of the industry codes used on Form T2125. What you want to avoid in the 30-day window before and after tax loss harvesting is a wash sale.

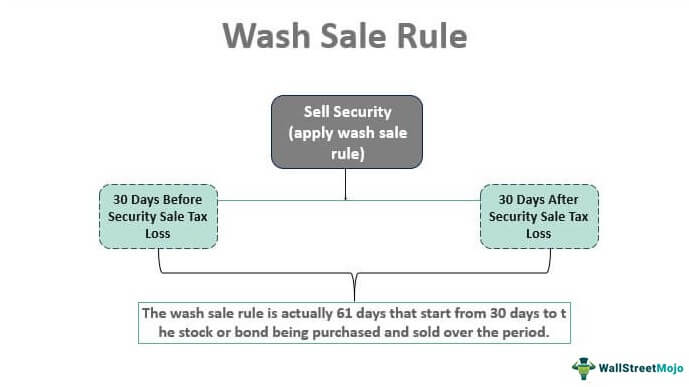

The rule prohibits you from claiming a tax loss if you repurchase the same security or a substantially similar security either 30 days before or 30 days after selling a security for a loss. Wash-sale rules prohibit investors from selling a security at a loss buying the same security again and then realizing those tax losses through a reduction in capital gains taxes. Fair Market Value is the market price of the cryptocurrency at the time you sold traded or disposed of it.

The wash sale rule prohibits an investor from taking a tax deduction if they sell an investment at a loss and repurchase the same investment or a. Understanding the Wash Sale Rules On Tax Loss Harvesting TLH The so-called wash sale rules are one of the oldest anti-abuse provisions of the Internal Revenue Code first originating with the Revenue Act of 1921 and substantively codified in the current IRC Section 1091 as a part of the general overhaul in developing the Internal Revenue Code of 1954. When completing Form T2125 Statement of Business or Professional Activities form T2121 Statement of Fishing Activities or Form T2042 Statement of Farming Activities you have to enter an industry code that corresponds to your main business activity.

A wash sale is a purchase of identical or substantially identical replacement shares of an asset you sold at a loss during that 61-day 30 days before. Fair Market Value - Cost Basis GainLoss. In our 1st example above 25000 is Christophers cost basis and 35000 is the fair market value at the time of the sale.

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

Calculating The True Benefits Of Tax Loss Harvesting Tlh

.jpg)

The Beginner S Guide To Cryptocurrency Tax Loss Harvesting Cryptotrader Tax

Tax Loss Harvesting Wash Sales Td Ameritrade

Tax Loss Harvesting And Wash Sales Seeking Alpha

Wash Sale Rule Definition Example How It Works

Tax Loss Harvesting Wash Sales Td Ameritrade